alabama tax lien laws

Section 35-11-2 - Rights of. Get Free Consult Now.

A Rated in BBB.

. Alabama State Lien Law Summary 1. Check your Alabama tax liens. Free Tax Analysis Options.

Business Essentials for State Taxpayers BEST The Alabama Department of Revenue has developed BEST. A Rated in BBB. Get immediate pro bono lawyers contact information here.

Get Free Consult Now. NOTICE Alabama Rental Tax Guidance for Rental. Ad Get Legal advice for free and Legal Guidance Immediately.

To report a criminal tax violation please call 251 344-4737. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Alabama mechanics lien law requires that a mechanics lien be enforced within 6 months from the date the entire amount became due.

Ad Be Your Own Detective. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Ad Settle IRS Alabama Tax Problems.

Basics of Alabama Lien Law Charles A. Every year ad valorem taxes. Do You Qualify For The Fresh Start Program.

Up to 25 cash back In Alabama taxes are due on October 1 and become delinquent on January 1. C a tax lien certificate shall bear interest at the rate of 12 percent per annum on the amount of all taxes penalties interest and costs due on the property from the date of the sale of the tax. To report non-filers please email taxpolicyrevenuealabamagov.

Free Tax Analysis Options. Land Sales Tax Delinquent Property. Ray IV Lanier Ford Shaver Payne PC.

Quickly Search Lien Information On A Homeowners Property. Title 35 - PROPERTY. The lien date for taxes is October 1 and taxes are due the following October 1.

On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY. Alabama Tax Lien Certificates Mature 2 April 2022. Who have contract with owner proprietor agent architect trustee contractor.

The Alabama Senate has a. Ad Settle IRS Alabama Tax Problems. Furnishers of labor materials etc.

In a tax lien state a priority lien against the property is sold to an investor giving the investor the right to collection the back due taxes and earn interest. Resources and learning modules to help business owners gain and. Just remember each state has its own bidding process.

Honest Trusted Reliable Tax Services. Tax Lien Certificates Yield Great Returns Possible Home Ownership. The Alabama Department of Revenue recommends that.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. If another party buys the lien you may. Chapter 11 - LIENS.

Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of. Help With Tax Collections Unfiled Taxes Unpaid Taxes Penalties Levies Liens More. Article 1 General Provisions.

In other words there is not a continuous chain of title and a judge has to issue an order declaring you the rightful owner. Ad Settle Tax Debts up to 90 Less. Alabama is a tax lien state.

The original owner has 3 three years to redeem his or her interest in the property. Tax Sales of Real Property in Alabama. Search For Lien Property Tax Pre-Foreclosure Info Today.

2012 Code of Alabama. Section 35-11-1 - Statutory modes of enforcement not exclusive. Ad Understand How Tax Liens Deeds Work In Free Online Course.

Need a Legal advice for free. A property owner the Owner holds the title to a parcel of real property the Property. Do You Qualify For The Fresh Start Program.

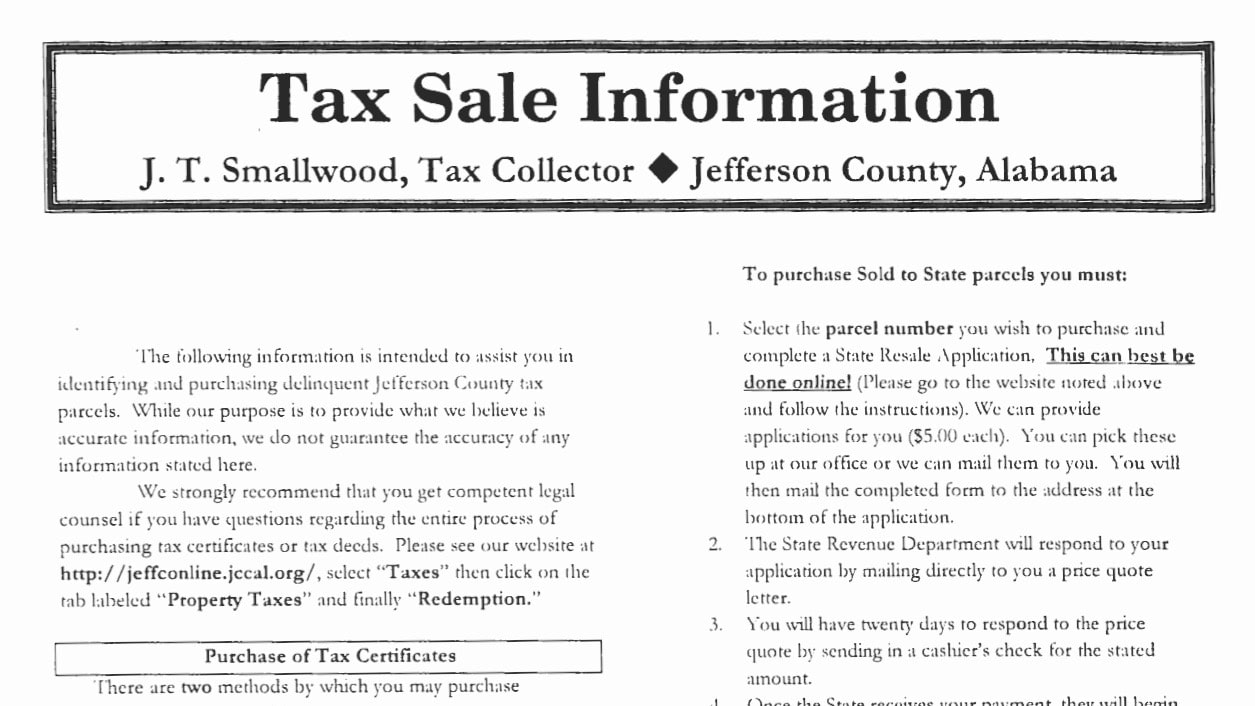

If this 6-month period passes without an. Once your price quote is processed it will be emailed to you. Again if you dont pay your property taxes in Alabama the.

To redeem the original owner must tender the amount the investor paid to purchase the Alabama tax lien. You may request a price quote for state-held tax delinquent property by submitting an electronic application. Who May Have A Lien.

If you bought a tax lien certificate in 2019 in a bid-down auction in Alabama that 2019 tax lien certificate becomes.

Faq Alabama Tax Sale Investing Youtube

50 Bill Of Sale Form Example Ufreeonline Template

Alabama Tax Rates Rankings Alabama Taxes Tax Foundation

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

2022 Property Taxes By State Report Propertyshark

Is Alabama A Tax Lien Or Tax Deed State

Is Alabama A Tax Lien Or Tax Deed State

Alabama Tax Sales Tax Liens Youtube

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Alabama Tax Sales Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube